proposed estate tax law changes 2021

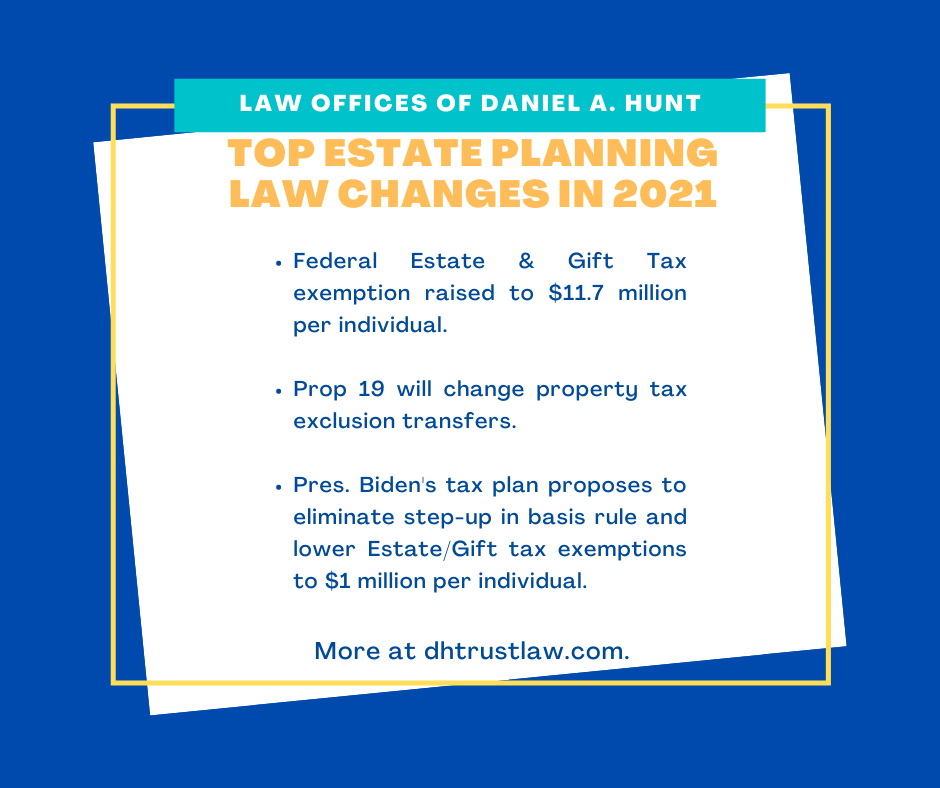

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any.

How Changes In Tax Laws Impact Your Estate Plan Snyder Law

Here are some of the possible changes that could take place if Sanders proposed tax changes become law.

. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. In the face of the potential of reduced exclusions amounts for estates and gifts as of January 1 2022 grantorsdonors may consider lifetime gifts this year. Thankfully under the current proposal the estate tax remains at a flat rate of 40.

Property owners will be notified by mail of their proposed new assessed values after November 10 2020. As many of you may know administrations come and go and when they do it is prime time for law changes. Introductory letters and an informational brochure were mailed to all owners of.

What is the sales tax rate in Piscataway New Jersey. This is the total of state county and city sales tax rates. The law would exempt the first 35 million dollars of an individuals.

On Sunday September 12 2021 the House Ways Means Committee the Committee released draft legislation as part of Congress ongoing 35 trillion budget reconciliation process. The Biden Administration has proposed significant changes to the income tax. State Senate Committee on the Environment.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. But it wouldnt be a surprise if the estate tax.

The minimum combined 2022 sales tax rate for Piscataway New Jersey is. The current 2021 gift and estate tax exemption is 117 million for each US. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction.

4089 was referred to the. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these.

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. July 14 2021 By Family Estate Planning Law Group. Proposals to decrease lifetime gifting allowance to as low as 1000000.

The price of democracy is vigilance - Senator Bob Smith D Middlesex Chairman of the NJ. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. Reduction in Federal Estate and Gift Tax Exemption Amounts.

That is only four years away and.

Tax And Estate Law Changes Financial Harvest Wealth Advisors

Estate Tax Law Changes Could Have Costly Implications Uhy

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

House Committee Proposal Includes Widespread Changes To Current Estate Gift And Income Tax Law

Impact Of Tax Laws Changes On Estate And Gift Taxes What You Need To Know And How To Act On It Now Credo Cfos Cpas

Op Ed Proposed Estate Tax Law Changes Hit Farms Hard El Paso Herald Post

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Navigating The Changes To Tax Laws In 2021 University Of Cincinnati

2021 Proposed Tax Law Changes Potential Impacts

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

Estate Tax Law Changes What To Do Now

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

How Your Estate Plan Is Impacted By The Proposed Tax Law Changes Youtube