laird superfood stock analysis

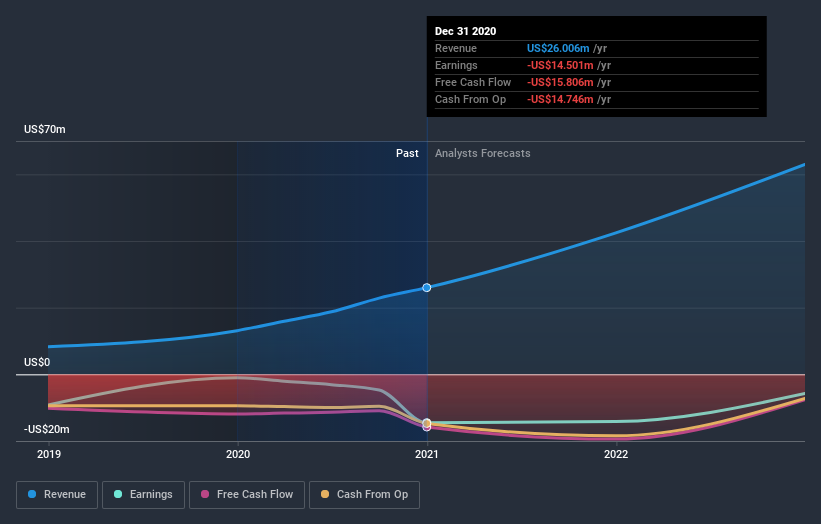

Includes annual quarterly and trailing numbers with full history and charts. The latest trend in earnings estimate revisions for the stock doesnt suggest further strength down the road.

Laird Superfood Stock Grows Revenue But Faces Inflation Nyse Lsf Seeking Alpha

LSF stock analysis and financial data including key statistics and ratios valuations historical price and financial performance of Laird Superfood.

. Price to Book Value per Share Ratio. InvestorsObserver gives Laird Superfood Inc LSF an overall rank of 40 which is below average. A rank of 40 means that 60 of stocks appear more favorable to our system.

Find the latest analyst research for Laird Superfood Inc. The price has fallen in 5 of the last 10 days but is still up by 344 over the past 2 weeks. Find the latest Laird Superfood Inc.

The stocks lowest day price was 297. Detailed balance sheet for Laird Superfood Inc. Is Further Upside Left in the Stock.

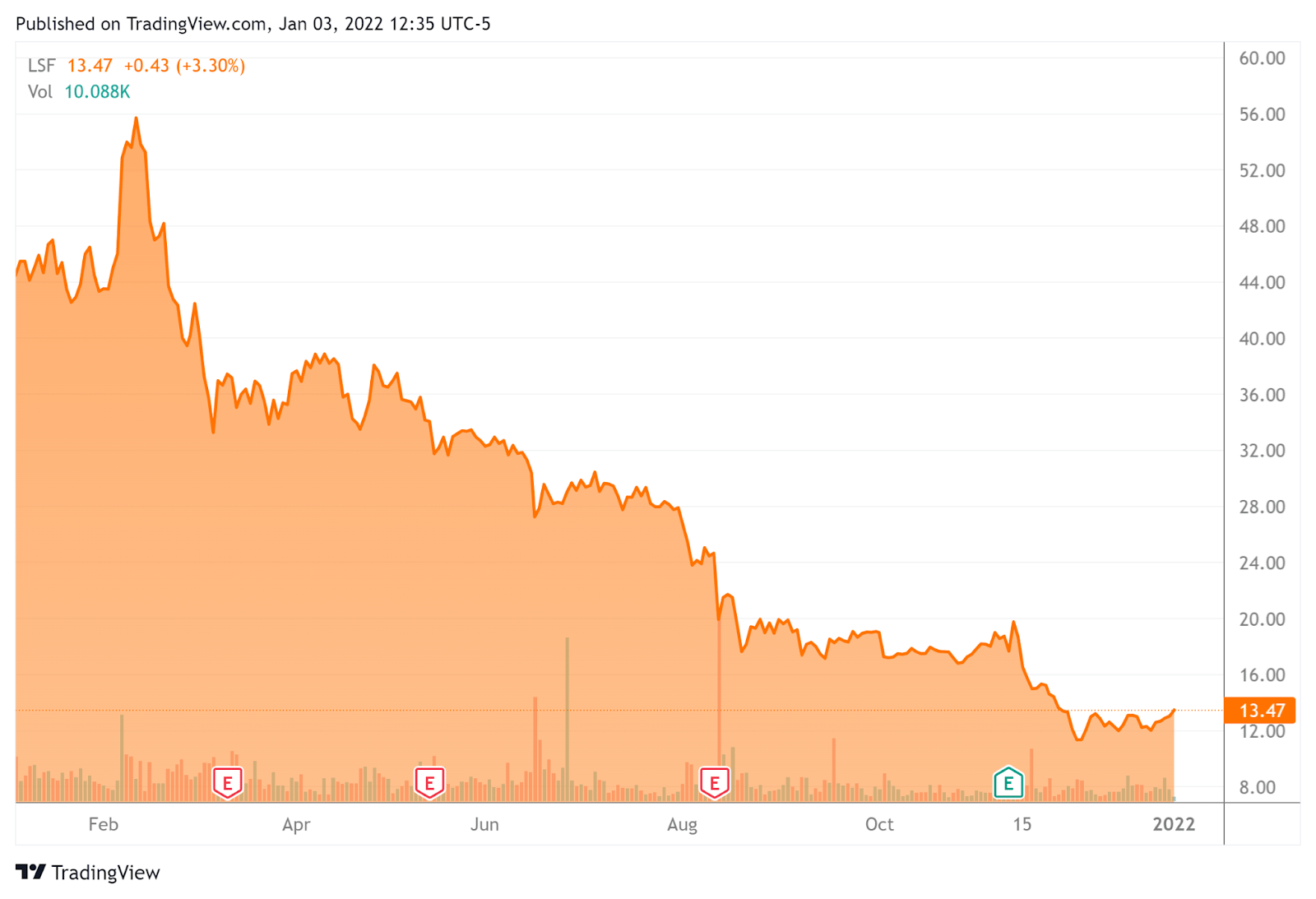

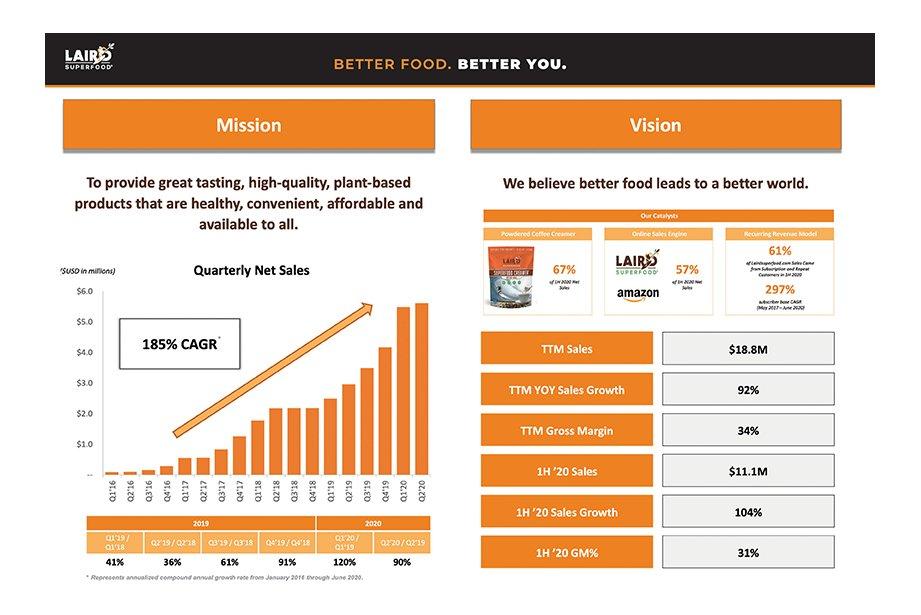

Intraday-269 1 week-1398 1 month-183 1 year-9161 YTD. Laird Superfood has a PB Ratio of 035. The core pillars of the Laird Superfood platform are Superfood Creamer coffee creamers Hydrate hydration products and beverage enhancing supplements harvest snacks and other food items and roasted and instant coffees.

Analysis and Forward-Looking Commentary. Is Further Upside Left in the Stock. OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the financial.

If you are looking for stocks with good return Laird Superfood Inc stock can be a bad high-risk 1-year investment option. Is an emerging consumer products platform focused on manufacturing and marketing differentiated plant-based and functional foods. By understating and applying Laird Superfood stock analysis.

LSF Q4 Earnings Expected to Decline - Zacks Investment Research1 month ago - Laird Superfood to Report Fourth Quarter and Full Year 2021 Financial Results on March 8 2022 - Business Wire. Summary of all time highs changes and price drops for Laird Superfood. Laird Superfood stock analysis indicators help investors evaluate how Laird Superfood stock reacts to ongoing and evolving market conditions.

LSF including the income statement balance sheet and cash flow statement. The stock lies the upper part of a very wide and falling trend in the short term and. The latest trend in earnings estimate revisions for.

Detailed financial statements for Laird Superfood Inc. 12 rows Company Description. Detailed statistics for Laird Superfood Inc.

Laird Superfood Inc real time quote is equal to 2910 USD at 2022-04-17 but your current investment may be devalued in the future. No changes to the price of Laird Superfood Inc stock on the last trading day Friday 29th Apr 2022. Laird Superfood is trading at 301 as of the 18th of March 2022 a -444 percent decrease since the beginning of the trading day.

LSF stock analysis from Seeking Alphas top analysts. During the day the stock fluctuated 1096 from a day low at 292 to a day high of 324. Real time Laird Superfood Inc.

How has the Laird Superfood stock price performed over time. LSF stock price quote stock graph news analysis. Get the latest Laird Superfood detailed stock quotes stock trade data stock price info and performance analysis including Laird Stock investment advice charts stats and more.

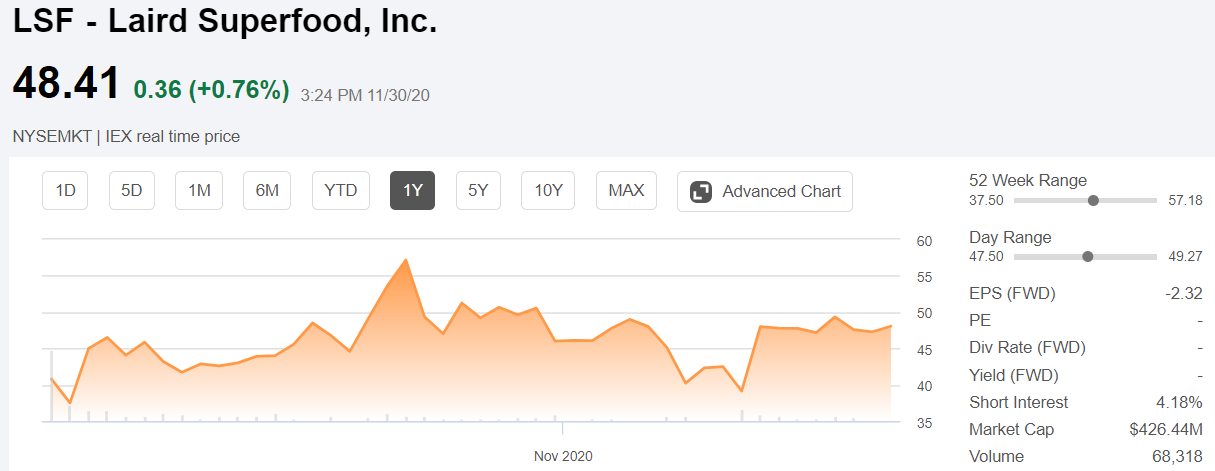

The stock surged by as much as 90 on the debut and is already up over 110 from the offering price in just the past 2 months. LSF including cash debt assets liabilities and book value. PB Ratios below 1 indicate that a company could be undervalued with respect to its assets and liabilities.

Exclusive research and insights from bulls and bears. The investors can use it to make informed decisions about market timing and determine when trading Laird Superfood shares will generate the highest return on investment. LSF witnessed a jump in share price last session on above-average trading volume.

Laird Superfood Inc is in the bottom half of stocks based on the fundamental outlook for the stock and an analysis of the stocks chart. Laird Superfood Inc. LSF stock including valuation metrics financial numbers share information and more.

The PE ratio of Laird Superfood is -091 which means that its earnings are negative and its PE ratio cannot be compared to companies with positive earnings. LSF witnessed a jump in share price last session on above-average trading volume. 3 weeks ago - Laird Superfood Reports Fourth Quarter FY2021 Financial Results - Business Wire1 month ago - Earnings Preview.

Financial ratios and metrics for Laird Superfood Inc. Find the latest Laird Superfood Inc. March 30 2022.

LSF stock quote history news and other vital information to help you with your stock trading and investing.

Laird Superfood Inc Lsf Soars 5 4 Is Further Upside Left In The Stock

2 Oversold Stocks That Are Poised For A Rebound

In Stunning Fall Laird Hamilton S Eponymous Superfood Stock Price Down Nearly 25 Today Over 50 For The Year

Laird Superfood A Big Wave Of Growth With Strong Momentum Nyse Lsf Seeking Alpha

How To Buy Laird Superfood Stock Ipo

Shares Of Laird Hamilton S Superfood Company Nearly Double On First Day Of Trading Geekwire

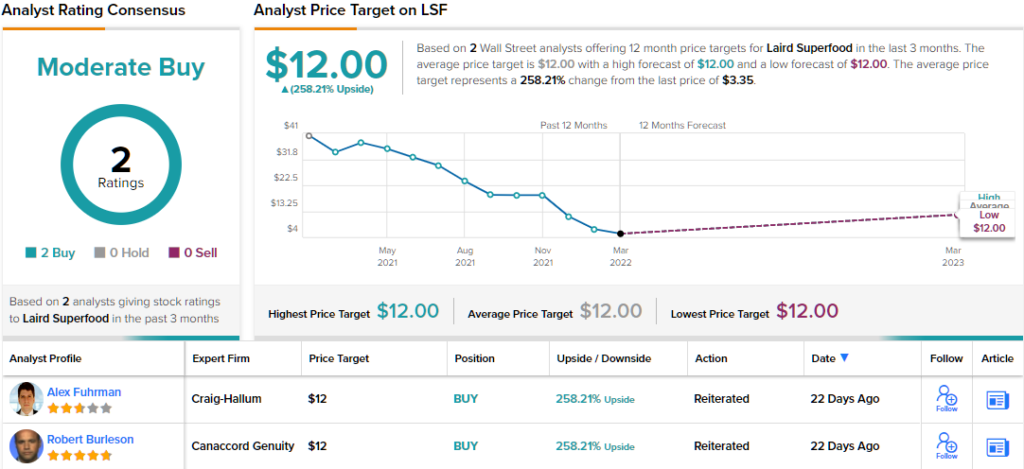

Laird Superfood Stock Looks Like A Buy 75 Below All Time High Seeking Alpha

Laird Superfood Opens New Customer Fulfillment Center In Sisters Oregon Business Wire

Laird Superfood Stock Looks Like A Buy 75 Below All Time High Seeking Alpha

Laird Superfood Stock Looks Like A Buy 75 Below All Time High Seeking Alpha

Laird Superfood Amex Lsf Quotes And News Summary Benzinga

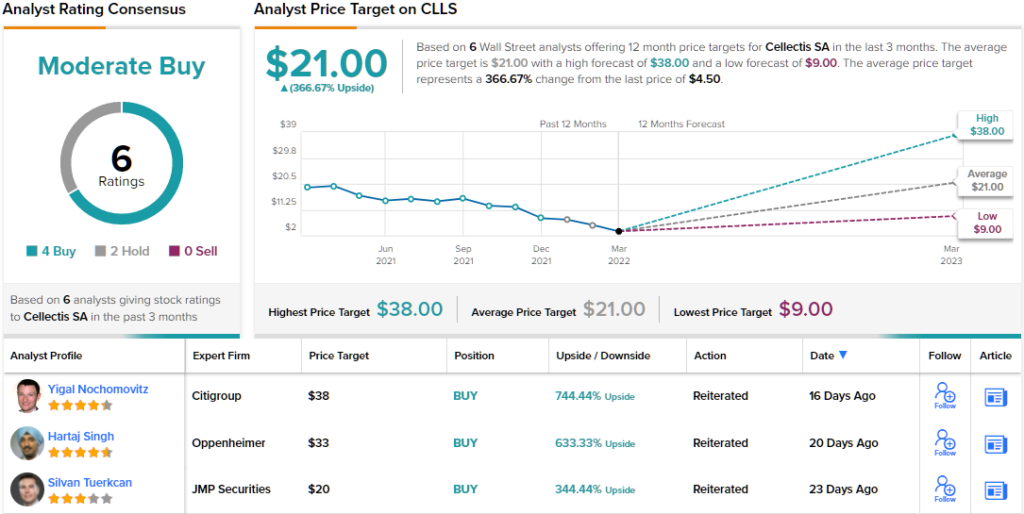

2 Oversold Stocks That Are Poised For A Rebound

Laird Superfood Inc Lsf Stock Price News Info The Motley Fool

Laird Superfood Stock Looks Like A Buy 75 Below All Time High Seeking Alpha

3 Strong Buy Stocks That Are Still Undervalued

Laird Superfood Inc Lsf Stock Price Us50736t1025 Marketscreener

Laird Superfood Stock Grows Revenue But Faces Inflation Nyse Lsf Seeking Alpha

What Is The Ownership Structure Like For Laird Superfood Inc Nysemkt Lsf Nasdaq

We Think Laird Superfood Nysemkt Lsf Can Easily Afford To Drive Business Growth