santa clara property tax due date 2021

Deadline to file all exemption claims. The due date to file via mail e-filing or SDR remains the same.

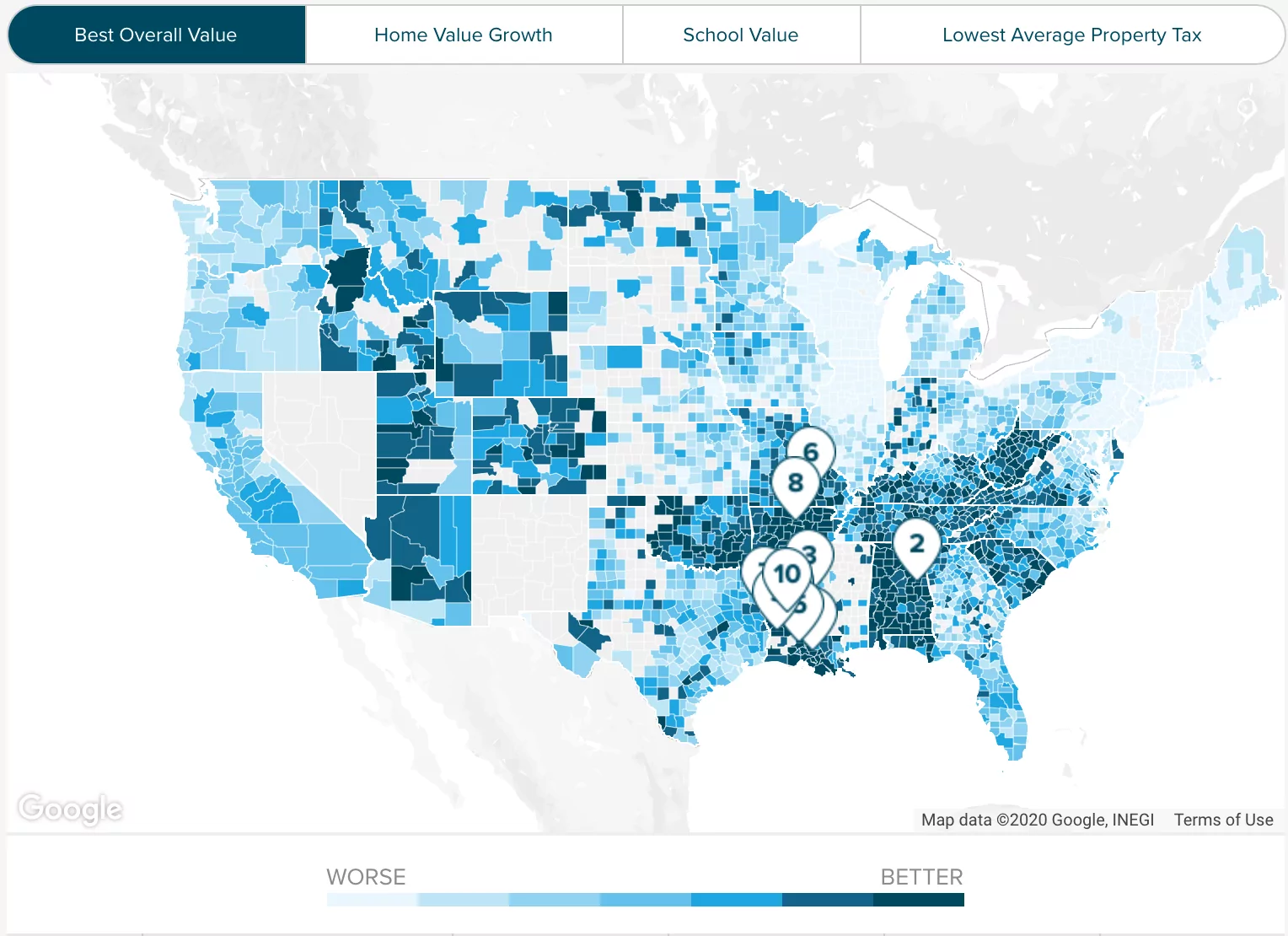

Santa Clara County Ca Property Tax Calculator Smartasset

If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time.

. Second Installment of the 2021-2022 Annual Secured Property Taxes is Due February 1 and Becomes Delinquent after April 11. Link is external. On Monday April 11 2022.

The tax was renewed and approved by the voters in November 2020. In addition to identifying the action and compliance dates the calendar also provides corresponding statutes for reference. You may pay your property taxes by credit or debit card a 234 convenience fee will be added or e-check no charge online.

August 31 - Unsecured deadline and a 10 penalty added. Santa clara county property tax due date 2022. If not paid by 500PM they become delinquent.

January 22 2022 at 1200 PM. Enter Property Parcel Number APN. May 27 2021 Property Tax Santa Clara Due Date Since the political mind and authorizes the states per the property due.

067 of home value. The Yolo County Tax Collectors Office will be open until 500 pm. May delay if state funds are not received on.

This leaves an unpaid balance of 2000. California county tax collectors cannot extend the April 10 deadline for making the second half of 2019-20 property tax payments but they. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. December 10 2021 due by. The secured property tax rate for Fiscal Year 2021-22 is 118248499.

Santa clara county property tax due date 2022. The santa clara county office of the tax collector collects approximately 4 billion. You may also pay by phone 877 590-0714.

Yearly median tax in Santa Clara County. Santa Clara Property Tax Due Date 2022. Business Property Statements are due April 1.

On Monday April 11 2022. Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder. Last Day to file Business Property Statement without 10 Penalty.

The following table shows the filing deadline for each county. 2022 Property Tax Calendar. For example lets say your first property tax installment is 5000 and by December 10th you elect to pay 3000 of it.

The County will still assess a 10 penalty plus 2000 cost for unpaid taxes beyond the property tax delinquency date. Postmarks are imprints on letters flats and parcels that show the name of the United States Postal Service USPS office that accepted custody of the mail along with the state the zip code and the date of mailing. January 1 - Unsecured bills mailed out and is the lien date for unsecured taxes.

The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30 2022. Santa Clara County has one of the highest median property taxes in the United. Each year the Board of Equalization prepares a Property Tax Calendar which identifies action and compliance dates of importance to assessing officials and taxpayers.

November 1 - First installment is due for Secured Property Tax and delinquent Unsecured. 12 foot sheet metal brake for sale sharepoint ellipsis missing santa clara county property tax due date 2022. July 1 - Beginning of fiscal year.

Due Date for filing Business Property Statement. 1 2022 - May 9 2022. September - Treasurer - Tax Collector mails out original secured property tax bills.

Office of the Treasurer Tax Collector. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April.

Due date for filing statements for business personal property aircraft and boats. Valley Water offers an exemption for qualifying low-income seniors from the Safe Clean Water special parcel tax. December 10 2021 due by.

Important Dates to Remember. Unsecured Property annual tax bills are mailed are mailed in July of every year. SANTA CLARA COUNTY CALIF.

10394 n stelling rd bill id. Pay Property Tax. The taxes are due on August 31.

Santa clara county has one of the highest median property taxes in the united states and is ranked 38th of the 3143. 2nd Installment due date is April 11 2022 by 500 PM. Business Property Statement Filing Period.

However this penalty will apply only to the balance due. Santa clara county property tax due date 2022. Property Tax 2022 Due DateIn quezon city payments made before january 31 for annual payments will receive a 20 discount while quarterly payments will receive a 10 discount if made before the due dates while in antipolo those who pay their real property tax before december 31 2021 will avail a 20 discount while those who pay on or before march.

Second installment of secured taxes due. Secured Property Tax bills are mailed in October. The regular appeals filing period will begin on July 2 2021 in each county and will end either on September 15 or November 30 depending on whether the C ounty Assessor has elected to mail assessment notices by August 1 2021 to all taxpayers with property on the secured roll.

Santa clara countys due date for property taxes is what it is. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

California Mechanics Liens And Related Construction Remedies Legal Forms Ceb Ceb

In Home Supportive Services Social Services Agency County Of Santa Clara

Tax Credit Info Do Course Fees Qualify For A 1098 T Tax Credit Frequently Asked Questions Ucsc Silicon Valley Extension

Santa Clara County Ca Property Tax Calculator Smartasset

Ventura County Ca Property Tax Search And Records Propertyshark

San Bernardino County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Calculator Smartasset

Ballot Measure E Transient Occupancy Tax Rates City Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

How Much Are Seller Closing Costs In California Soldnest

San Bernardino County Ca Property Tax Search And Records Propertyshark

How Much Are Seller Closing Costs In California Soldnest

San Bernardino County Ca Property Tax Search And Records Propertyshark

San Bernardino County Ca Property Tax Search And Records Propertyshark

Frequently Asked Questions Weed Abatement County Program County Of Santa Clara